Each year, the Valuer-General independently and objectively determines Site and Capital Values for all rateable properties across the State.

The Valuer-General also undertakes specialist valuations for government and statutory authorities on financial, disposal and acquisition matters.

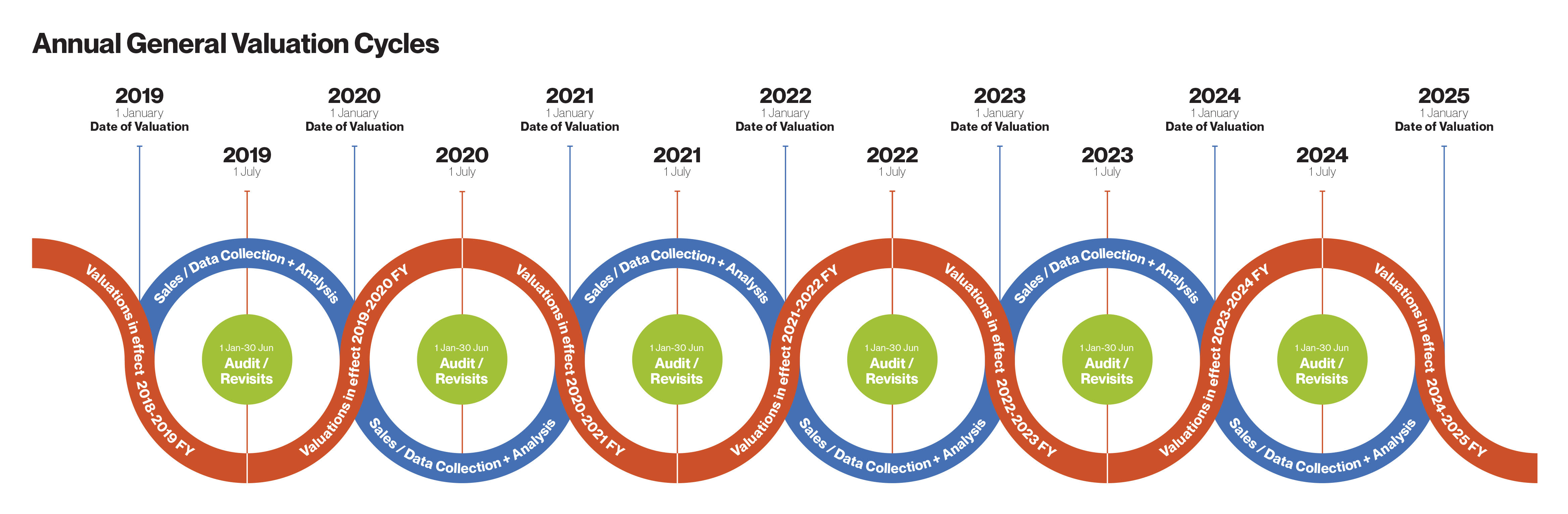

Property valuations determined as part of the annual General Valuation aim to reflect market value and are based on how the market has performed in the prior calendar year. The Date of Valuation is 1 January and valuations come into effect on 1 July each year.

There are approximately 930,000 properties in our state, each requiring a Site Value and Capital Value (including a number of occupancy assessments eg. an office building with many tenants). This is over 2 million valuations determined by the Valuer-General every year and is constantly growing as our state continues to grow.

If you could physically inspect 10 properties per day, that would be 50 properties per week, or 2,600 per year – which is only 0.28% of all the property in the state! That would mean 358 valuers working round the clock – which is not only impossible, but not sensible or necessary.

Therefore, mass appraisal is the primary valuation methodology which identifies submarket groups which are then analysed using sales evidence to derive an annual index. Indexation occurs across submarket groups and is not applied to specific properties, rather the submarket group as a whole.

The below image illustrates the continuing cycle of the annual General Valuation through the sales and data collection and analysis process whilst values for the current financial year are in effect.

- Location

- Site use - the highest and best use of the land

- Site influences -shape, topography, nearby uses and frontage

- The building - size, age, condition, style, improvements and construction type

- Site details - land classification, zoning, land area and heritage restrictions

Your property's value can be found via:

- Statutory authority notices such as council rates, water and sewerage rates or Emergency Services Levy and land tax (where applicable)

- South Australian Land Information System (SAILIS) - online land and property information

A notice of valuation is delivered to a property owner on statutory authority notices, including Local Government, SA Water and RevenueSA.

A property owner or occupier has the right to object to the valuation and have the Valuer-General’s decision reviewed by an Independent Valuer (Review by Valuer) and the South Australian Civil and Administrative Tribunal (SACAT).