Every year, property values are reviewed across the State to determine the Site Value and Capital Value. These values are used by relevant statutory bodies to determine the amount of land-based rates and taxes to be charged.

Through the Office of the Valuer-General, any property owner or occupier who does not agree with their valuation may lodge an objection and have their property valuation re-assessed. The most common reason for an objection is where a property owner or occupier considers their property value is too low or too high.

Step 1: Receipt of Notice of Valuation

Upon receipt of the first quarter Notice of Valuation in the form of a rating and taxing notice from the following, take note of the valuation of your property:

- Council (Capital Value)

- SA Water (Capital Value)

- Revenue SA - Emergency Service Levy (Capital Value)

- RevenueSA – Land Tax (Site Value)

If your concern relates to the amount of rates and taxes payable, please contact the relevant rating authority.

Step 2: Understand your Property Valuation

The first step before objecting, is to understand your property valuation and the local property market. The Date of Valuation is 1 January each year. It is reflective of how the market has performed in the prior calendar year (eg. 2025-2026 financial year property values are based on property sales throughout 2024).

Investigating sales data and information relevant to your area (as at 1 January) and providing comparable market evidence will help support your objection.

Our Understanding 2025-2026 Property Values fact sheet assists in outlining how the 2024 property market influenced 2025-2026 property valuations.

Step 3: Lodge an Objection

If you remain concerned with the valuation of your property following Step 2, your objection must be lodged in writing to the Valuer-General within 60 days of receipt of the first quarter rates notice.

An objection to either Site Value, Capital Value, or both, should be lodged. Objecting to one value does not necessarily automatically change the other.

You must provide a detailed statement of your grounds for objection. If you do not meet these requirements, you may be contacted to provide further information.

An objection is a formal process and there are specific legislative requirements for both you and the Valuer-General. See Sec 24 and 25 of the Valuation of Land Act 1971(external site)(PDF) (external site) (PDF) (external site) (PDF) for further information.

There are several ways to object to the valuation of your property.

To complete an online Objection or print a form visit sa.gov.au(external site) (external site) (external site).

There is no fee for lodging an objection.

Note:

- Rates and taxes are still due and payable by the due date even if an objection has been lodged.

- An objection cannot be lodged to a value which is no longer in force (eg. a previous financial year). See Objecting to a Site Value no longer in force below, for further information about Land Tax objections.

Step 4: Review of your Objection

Once received by the Office of the Valuer-General, the objection application is reviewed and assessed by a qualified property valuer from Land Services SA, the States' service provider.

The property valuer reviews your property on an individual basis with the information provided in step 3. Sales of comparable properties throughout the previous calendar year are also investigated and utilised to assist in determining the value of the subject property.

The property valuer provides a recommendation to the Office of the Valuer-General to either reduce or maintain the current value (or in the case where the objector thinks the value is too low, it may be recommended to increase the value).

The Office of the Valuer-General audits the recommendation and makes necessary changes by allowing or disallowing the objection.

If there is a change to your property value, the valuation roll will be updated, and relevant rating and taxing authorities will be notified. Please contact them to discuss any matters related to your rates.

Step 5: Objection Decision Notification

You will be provided with the Valuer-Generals' objection decision letter upon completion of the objection, via email or post.

Objection outcomes are usually provided within 12 weeks of receipt of your objection. This can be longer if the subject property is more complex.

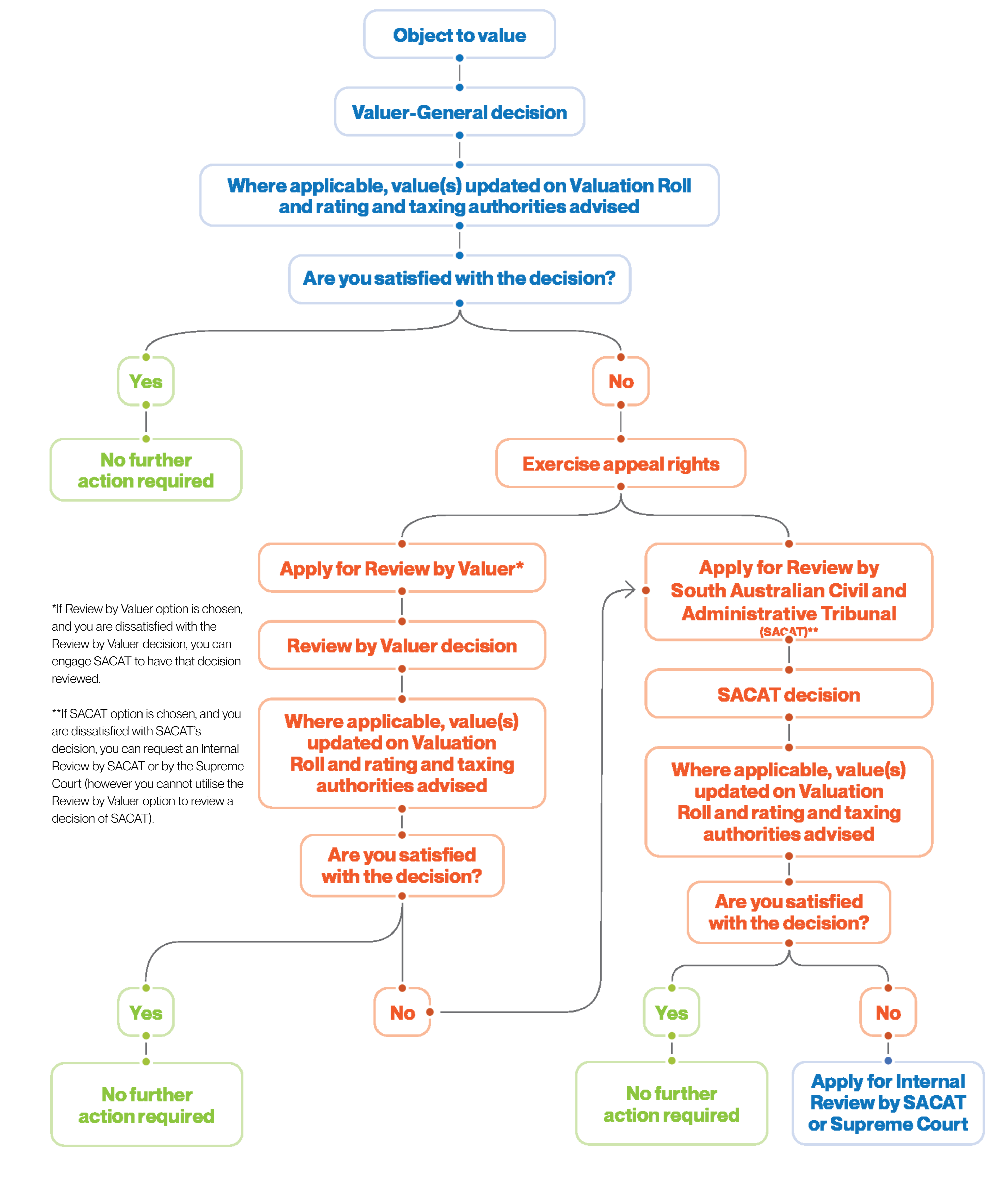

Step 6: Further Review

Should you remain concerned with the objection decision, you have a choice of two options to have the valuation reviewed. These are:

Review by the South Australian Civil and Administrative Tribunal (SACAT)

Other Objection related matters:

Objecting to the amounts of rates and taxes payable

If you wish to object to the amount payable which appears on your rates notice please contact the relevant rating authority - Local Council, SA Water or RevenueSA.

The Valuer-General sets the property value, not the rate in the dollar used by the rating authorities. The ‘About council rates’ (external site) (PDF) (external site) (PDF) fact sheet issued by the Local Government Association may assist with understanding how the amount payable is determined.

Objecting to a Site Value no longer in force

The Office of the Valuer-General cannot accept an objection to a value which is no longer in force.

However, if you have received a Land Tax notice for a prior financial year, you need to enquire with RevenueSA to see if you are eligible to request for review of that value. Further information is available here (external site) (external site) (see Requesting review of site value no longer in force (Land Tax) section).

Objecting to Land Use

Further information relating to Objections to Land Use is available here.

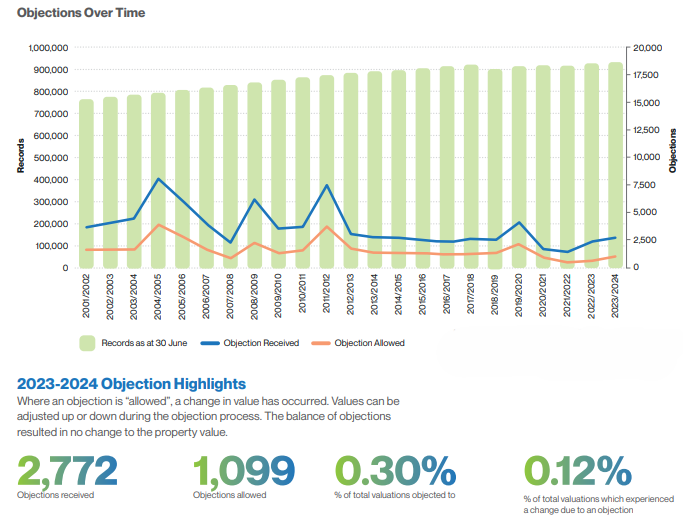

The following graph outlines the number of objections received and allowed against the amount of valuation records over time.

Note: as Objections continue to be finalised over a period of time, the results for the 2024-2025 financial year are not yet complete.